We can advise on pre-approvals, new purchases, bridging loans or refinances.

Whether you are a first home buyer, a small-time or experienced property investor, or looking to refinance, we can provide advice and seek finance approval to meet your requirements. Our aim is always to have a positive effect on your finances and other financial needs. If we feel for any reason we cannot add value, we can usually let you know within the first interaction.

Feel free to spend 10 minutes registering and completing some basic information we will require by clicking on the “GET STARTED” button on the home page. Once this very simple form is completed, we will be in touch promptly.

Buying your first home is exciting, the prospect of a place that is truly your own.

We are passionate about first home buyers and are experts that value assisting first home buyers with what can be a minefield of information.

Our advisers can assist you with:

You may have a property or even own several; you may be a first home buyer wanting to buy an investment property.

Whatever the case, we are here to support you and provide expert advice and more.

Our advisers can assist you with:

In summary of the above, we’ll give you professional advice on what you can borrow, your mortgage structure, and the most competitive lending package we can recommend. We’ll manage the process of obtaining finance with the banks and can work with your lawyer, accountant, estate agent, and any other professional or authorised party to achieve the result you are seeking.

In addition to requesting and obtaining paperwork and putting together a well-presented application for the bank(s) assessment, we can:

Whether it be for a new build, or major construction, or a more complicated demolition job, we can help.

There are so many different types of ways to contract a build or renovation. Here are your typical methods:

We’ll manage the finance process for you. We’ll ensure you get the best lending arrangement for your situation and provide expert advice based on your scenario.

It is completely normal to be a bit lost with construction loans; one of our friendly team can provide professional advice to help you on your journey.

Have you been turned down by the banks? Need an expert opinion on whether you are likely to meet bank lending criteria before wasting hours of your time?

There is a growing market for Non-Bank lending institutions.

The main banks can take a conservative lending approach to certain risks within lending applications. This does not mean you are necessarily unworthy of borrowing money; it may mean that alternative lending options are required to be sought.

Here are some examples of non-bank lending applications, where main bank options are unlikely to be available:

Bridging finance where there is no guarantee of repayment of lending and thus proving satisfactory servicing becomes a real issue. We call this ‘open-ended bridging’ and although it can be convenient to buy first, and then sell your property, it may come as a surprise that even though your ‘end position’ works well within bank criteria, the fact your existing property is not in fact sold (unconditionally) at the time you purchase or wish to, the bank could make this challenging if not impossible to obtain approval. We take a pragmatic approach by looking at whether we can try the banks and will produce a well-presented file for their consideration. We will also discuss what non-bank options may exist.

If you are newly self-employed (have less than two years’ worth of formal financials), or possibly you have had a blip year (have earned materially less than in previous years) you may struggle to have finance approved by a mainstream bank. We can look at alternatives.

If you are asset rich and cash poor and wish to raise finance, you will probably need a non-bank lender to provide approval. With changes to the CCCFA at the end of 2021, if you are deemed to fit within CCCFA lending criteria, obtaining lending even from non-bank lenders can prove challenging – we will give you a transparent and professional opinion on this as early on in the piece as possible.

You may have a credit rating impairment such as resolved or unresolved credit adversity. You may be discharged from bankruptcy or have undergone a non-asset procedure. This list is not exhaustive. The banks tend to take a hard line on credit impairment issues, even ones that are repaid that could have been a few years ago.

You may not have an indefinite returning resident’s visa for New Zealand and seek a low equity loan.

Tax debt. Many self-employed Kiwis (in particular) may find themselves in situations where they owe the IRD money and therefore will want to borrow money to clear the debt. It can work out less costly to borrow money from a non-bank as opposed to paying IRD penalty interest and fees. People can end up having debt with the IRD for a number of reasons and we recommend consulting with your accountant or other qualified tax professional for guidance in managing tax obligations.

We have access to a variety of non-bank short and longer-term lending solutions and are enthusiastic about finding you the right option for you. It is important that skill and diligence are exercised with this more specialised lending; an inferior solution may end up costing a dramatic additional amount if the wrong non-bank is recommended and an offer is accepted by you.

An ‘Exit strategy’ is also an integral part of this conversation with an adviser that has your best interests at heart or if the solution is a long-term solution, then understanding this upfront. Your finance arrangement may only sit with a non-bank lender for a brief time. We can approach a bank when and if you meet their criteria. We will explain this in our written advice to you to convey clear expectations and to enable a material understanding of this, as part of the professional process we undertake for you.

If upfront fees are applicable, we will discuss with you as part of our Nature & Scope of Advice process, at the initial stages of engagement.

Getting you finance through a main bank is always the priority, if it is viable.

The team at RSFA will look pragmatically at what is best for you, and not the bank. It may be that we recommend remaining with your own bank – advice is key. We welcome new and existing clients to contact our friendly team. We typically do not charge for re-fixing advice and will disclose any charges that may exist early in our engagement for your consent. Please note banks do send online offers to clients and we will request a copy of the offer to commence the advice process.

In summary, we can assist with:

Finance cost speaking, this is a pivotal moment and dealing with your current bank only provides an option with your current bank! And the deal kicker is on any given week we are aware of and monitor the best rates and packages are in the market as we deal with all the banks; how could your existing bank possibly profess the same?

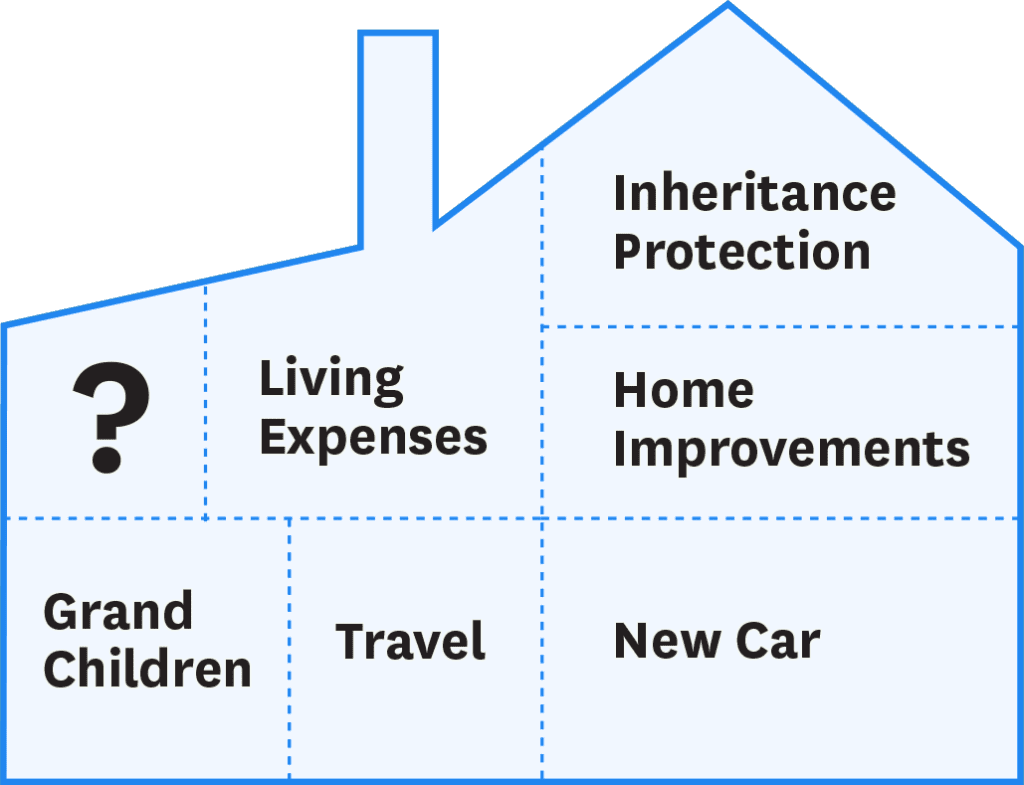

You may look at your equity in your home like this:

If you are 60 and above and have equity in your home, you may qualify for a Home Equity Loan (also known as ‘Reverse Mortgages’). Getting you finance through a main bank is always the priority, if it is viable.

Please complete the form below and we will be in contact with you.