Refinancing

Refinancing your mortgage can be a smart move to save money and improve your financial situation. At Real Savvy Financial Advice, we offer expert advice to help you navigate the refinancing process and secure the best possible terms.

In addition to requesting and obtaining paperwork and putting together a well-presented application for the bank(s) assessment, we can also help assess your current structure and situation and consider what your current bank versus what other banks can provide.

Our financial advisers will also provide specific refinancing advice on the best mortgage structure and bank for you which may allow for:

Get started with RSFA

With over 20 years of industry experience, Rod and his team provide expert guidance and top-notch service to help you achieve your financial goals. Reach out to our team today.

Understand your finances with our financial analysis tools

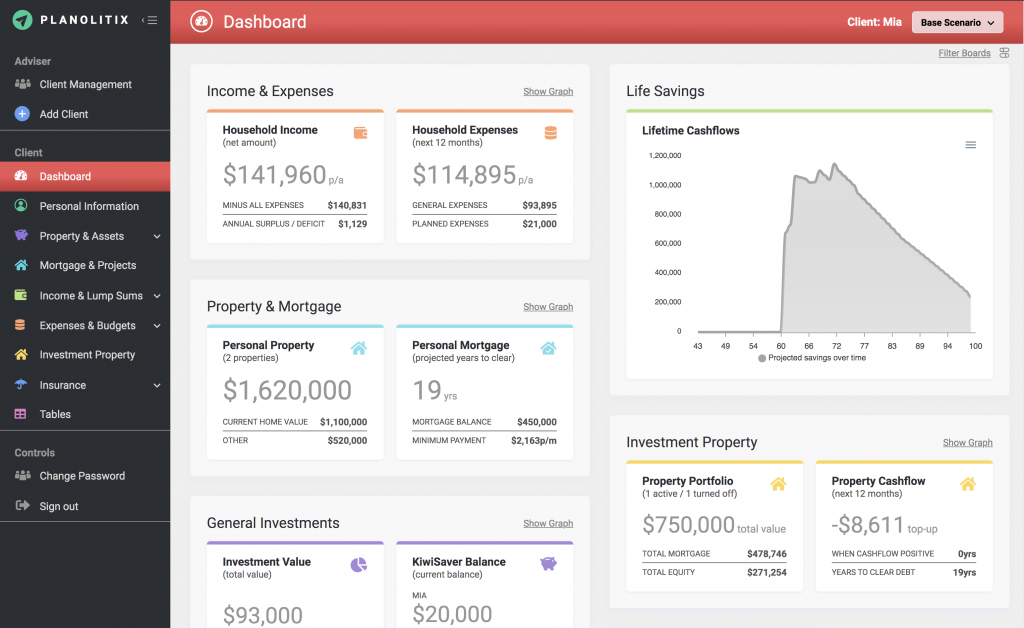

RSFA Financial Advisers leverage Planolitix to provide clients with comprehensive financial planning and advanced data analysis, ensuring tailored solutions for optimal financial outcomes.

By utilising this sophisticated tool, RSFA Financial Advisers enhance decision-making processes and maximise investment strategies for their clients.

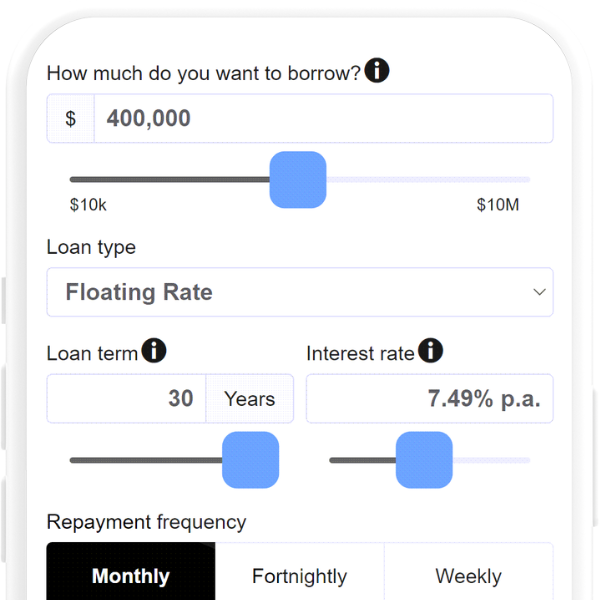

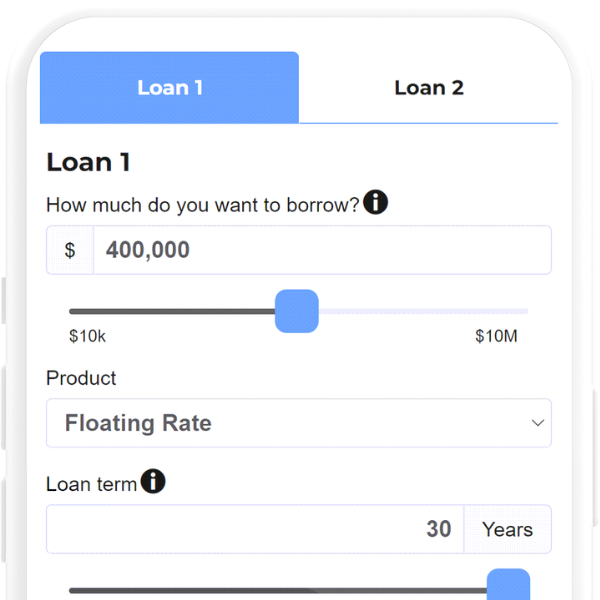

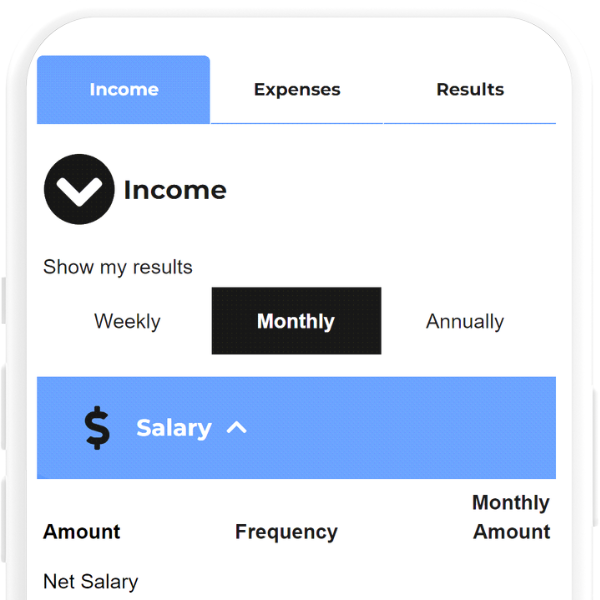

Useful Calculators for Refinancing

Our website offers a variety of easy-to-use financial calculators designed to help you make informed decisions.

Frequently Asked Questions

Refinancing can lower your interest rate, reduce monthly payments, shorten your loan term, or allow you to tap into your home's equity. These benefits can lead to significant savings and better financial management over time.