Non-Bank Lending

Have you been turned down by the banks? Need an expert opinion on whether you are likely to meet bank lending criteria before wasting hours of your time?

There is a growing market for Non-Bank lending institutions.

The main banks can take a conservative lending approach to certain risks within lending applications. This does not mean you are necessarily unworthy of borrowing money; it may mean that alternative lending options are required to be sought.

We have access to a variety of non-bank short and longer-term lending solutions and are enthusiastic about finding you the right option for you. It is important that skill and diligence are exercised with this more specialised lending; an inferior solution may end up costing a dramatic additional amount if the wrong non-bank is recommended and an offer is accepted by you.

An ‘Exit strategy’ is also an integral part of this conversation with an adviser that has your best interests at heart or if the solution is a long-term solution, then understanding this upfront. Your finance arrangement may only sit with a non-bank lender for a brief time. We can approach a bank when and if you meet their criteria. We will explain this in our written advice to you to convey clear expectations and to enable a material understanding of this, as part of the professional process we undertake for you.

If upfront fees are applicable, we will discuss with you as part of our Nature & Scope of Advice process, at the initial stages of engagement.

Getting you finance through a main bank is always the priority, if it is viable.

Get started with RSFA

With over 20 years of industry experience, Rod and his team provide expert guidance and top-notch service to help you achieve your financial goals. Reach out to our team today.

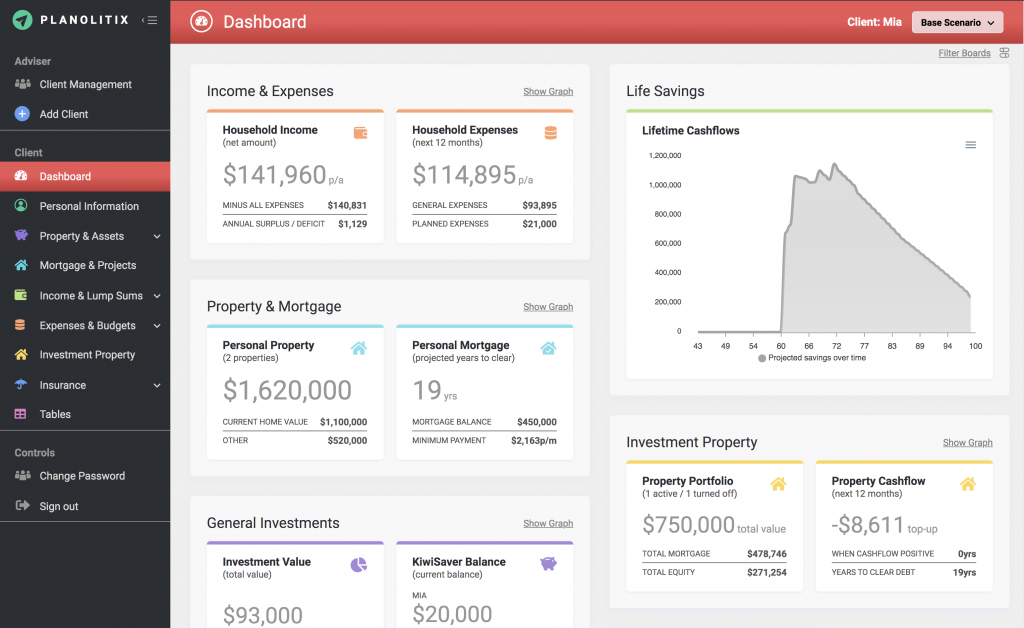

Understand your finances with our financial analysis tools

RSFA Financial Advisers leverage Planolitix to provide clients with comprehensive financial planning and advanced data analysis, ensuring tailored solutions for optimal financial outcomes.

By utilising this sophisticated tool, RSFA Financial Advisers enhance decision-making processes and maximise investment strategies for their clients.

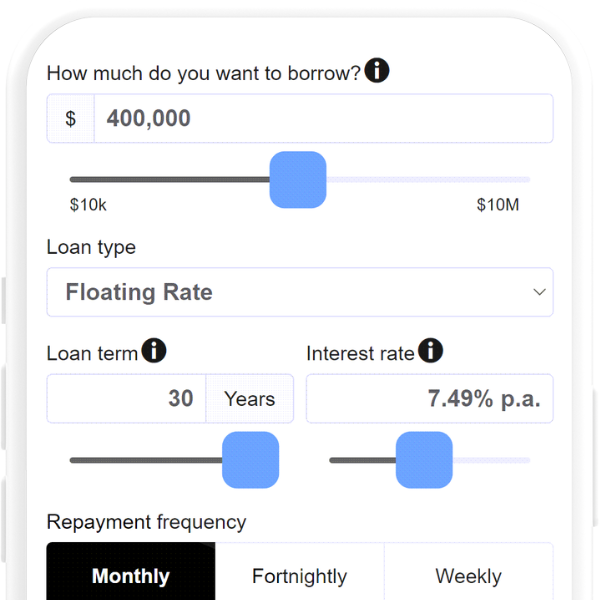

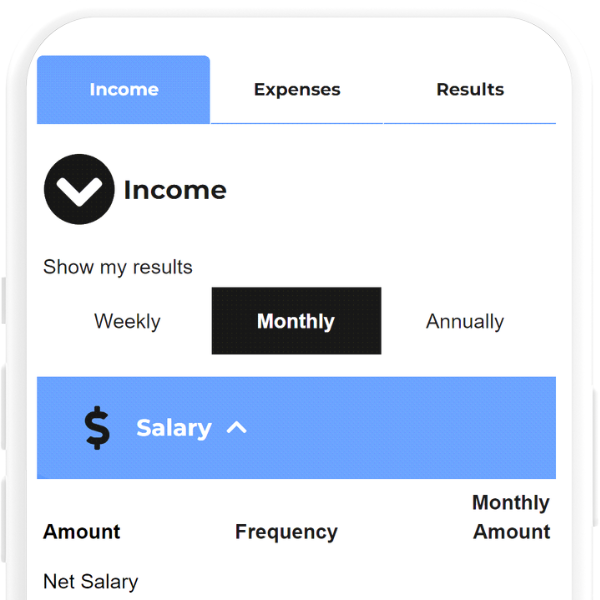

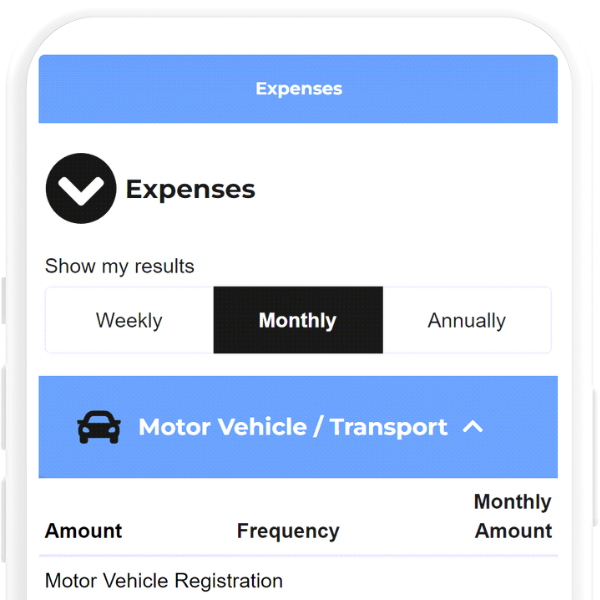

Useful Calculators for Non-Bank Lending

Our website offers a variety of easy-to-use financial calculators designed to help you make informed decisions.

Frequently Asked Questions

Non-bank lending involves borrowing from financial institutions that are not banks, such as credit unions, building societies, or private lenders. These lenders often offer more flexible terms, quicker approvals, and tailored solutions compared to traditional bank loans.