Mortgage Protection Insurance

Mortgage protection insurance is a critical safeguard for families in New Zealand, providing financial security in the event of unforeseen circumstances that could impact your ability to repay your mortgage.

Mortgage protection insurance ensures that your mortgage repayments are covered during times when you might be unable to work. By protecting against the risk of defaulting on your mortgage, it helps prevent the potential loss of your home and shields your family from financial hardship.

The financial relief provided by mortgage protection insurance allows you to focus on recovery and finding new employment without the added stress of looming mortgage payments. It covers monthly mortgage repayments, giving you peace of mind that your home is secure, even during challenging periods.

Mortgage protection insurance also helps maintain your credit rating by ensuring that mortgage payments are consistently made on time. This not only preserves your current financial standing but also supports your long-term financial health and stability.

Overall, having mortgage protection insurance offers invaluable security and reassurance, knowing that your family can remain in their home and maintain their standard of living, regardless of life’s uncertainties.

The RSFA 4 Step Process

Step 1

Identify your insurance objectives via a needs analysis.

Step 2

Prepare a personalised statement of advice once your needs are established, and discuss with you.

Step 3

Once you are satisfied we will implement your Protection Plan (RSFA assists with the application form and liaising with the insurer to achieve the best-underwritten terms).

Step 4

Provide ongoing service by way of annual reviews (there may be a need to review in-between times).

Get started with RSFA

With over 20 years of industry experience, Rod and his team provide expert guidance and top-notch service to help you achieve your financial goals. Reach out to our team today.

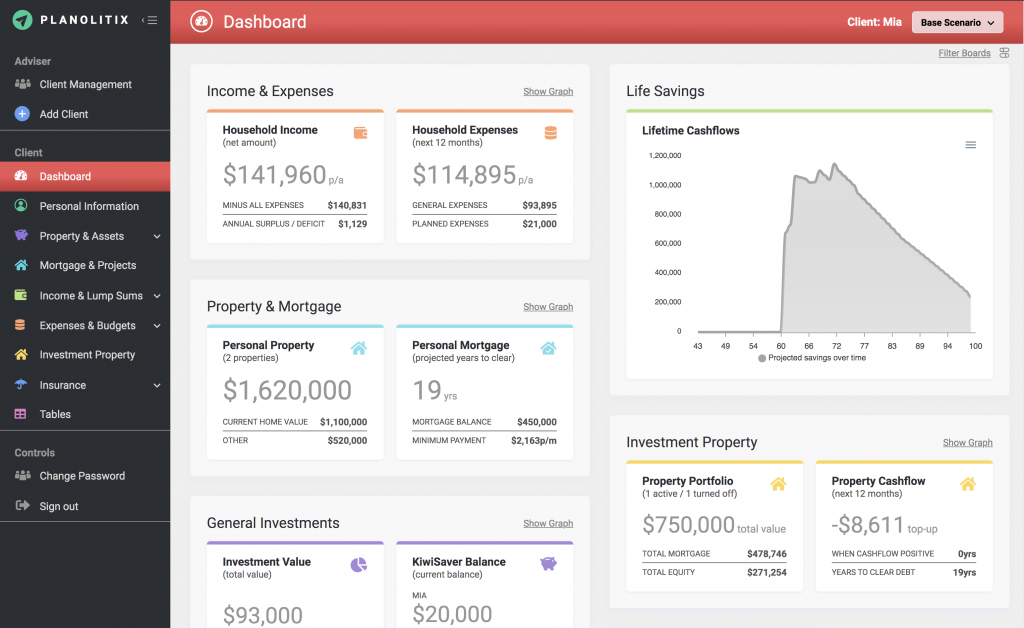

Understand your finances with our financial analysis tools

RSFA Financial Advisers leverage Planolitix to provide clients with comprehensive financial planning and advanced data analysis, ensuring tailored solutions for optimal financial outcomes.

By utilising this sophisticated tool, RSFA Financial Advisers enhance decision-making processes and maximise investment strategies for their clients.

Frequently Asked Questions

Mortgage protection insurance specifically covers your mortgage repayments in the event of death, disability, or critical illness, ensuring that your home remains secure. Traditional life insurance provides a lump sum payment that can be used for various expenses, not just mortgage payments. Mortgage protection insurance is designed to address the specific need of keeping your home safe.