Refixing or Restructuring

The team at RSFA will look pragmatically at what is best for you, and not the bank. It may be that we recommend remaining with your own bank – advice is key.

We welcome new and existing clients to contact our friendly team. We typically do not charge for re-fixing advice and will disclose any charges that may exist early in our engagement for your consent. Please note banks do send online offers to clients and we will request a copy of the offer to commence the advice process.

In summary, we can assist with:

Note, most banks allow you to fix up to 60 days prior to your fixed rate renewal. We therefore highly recommend being in touch around 2 ½ to 3 months prior to the renewal of your fixed term for these reasons:

Finance cost speaking, this is a pivotal moment and dealing with your current bank only provides an option with your current bank! And the deal kicker is on any given week we are aware of and monitor the best rates and packages are in the market as we deal with all the banks; how could your existing bank possibly profess the same?

Get started with RSFA

With over 20 years of industry experience, Rod and his team provide expert guidance and top-notch service to help you achieve your financial goals. Reach out to our team today.

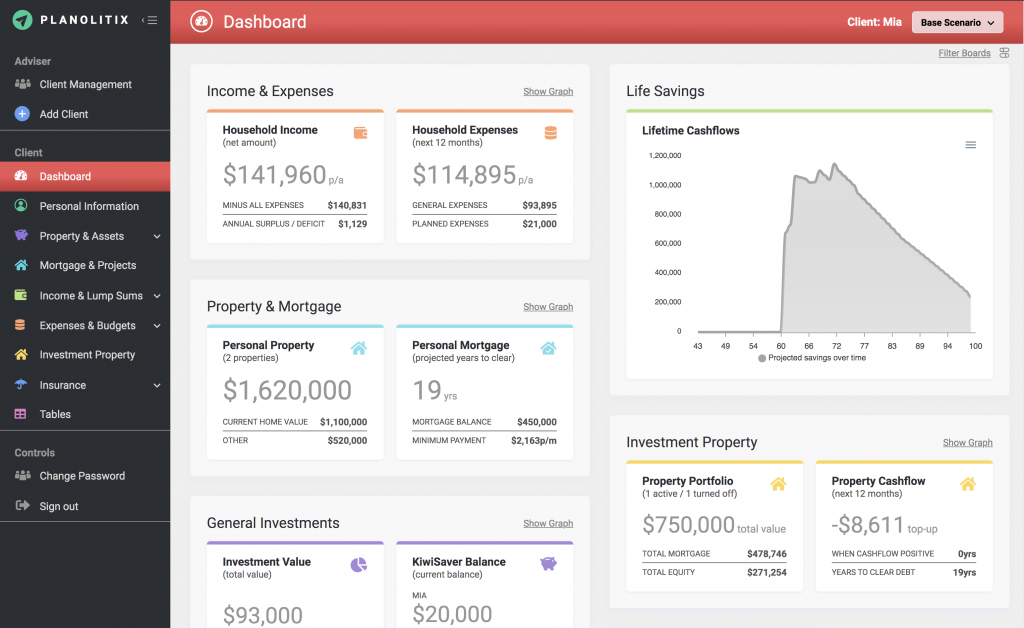

Understand your finances with our financial analysis tools

RSFA Financial Advisers leverage Planolitix to provide clients with comprehensive financial planning and advanced data analysis, ensuring tailored solutions for optimal financial outcomes.

By utilising this sophisticated tool, RSFA Financial Advisers enhance decision-making processes and maximise investment strategies for their clients.

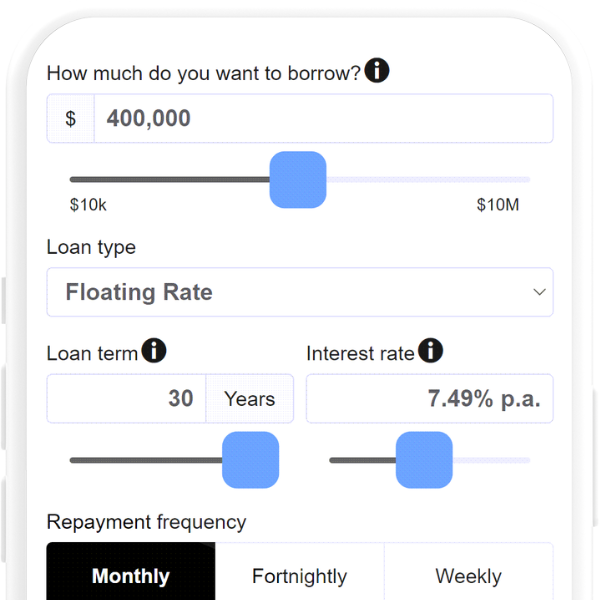

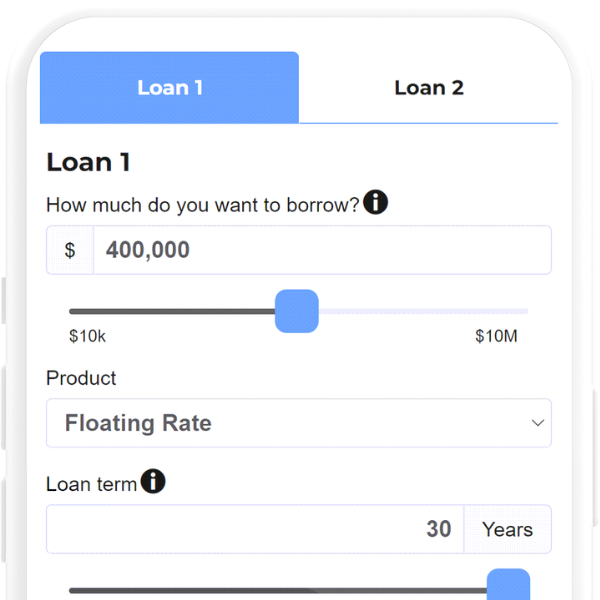

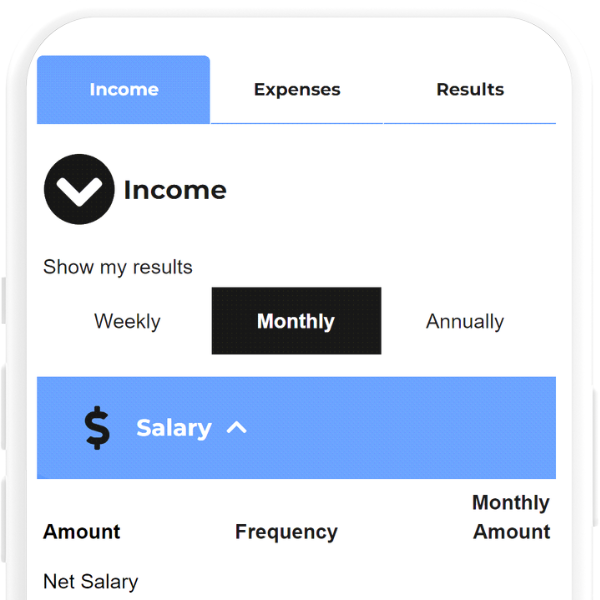

Useful Calculators for Refixing or Restructuring

Our website offers a variety of easy-to-use financial calculators designed to help you make informed decisions.

Frequently Asked Questions

Refixing involves renewing your mortgage at a new fixed interest rate, while restructuring may involve changing the loan term, repayment schedule, or splitting the loan into fixed and variable portions. Both options aim to better align your mortgage with your financial goals.