Income Protection Insurance

This cover provides replacement income if you are unable to work due to sickness or injury, safeguarding your “biggest asset”, your ability to earn an income, preserving your financial wellbeing from possible financial devastation.

At RSFA, we recommend clients prepare for several months without most of their net income. This is a daunting prospect, but income protection insurance provides a safety net, ensuring you have a steady income if you're unable to work due to illness or injury.

Many confuse mortgage protection with income protection insurance. While mortgage protection covers your mortgage repayments, income protection replaces a portion of your income, allowing you to cover various living expenses. Income protection benefits are typically a percentage of your pre-tax income, providing a reliable income stream for all living costs.

Both types of insurance generally have the same claim threshold: being unable to work due to a medical condition. However, income protection offers broader coverage, extending beyond mortgage payments to cover other financial obligations. It helps you maintain your lifestyle and financial commitments without added stress, giving you peace of mind to focus on recovery and well-being.

The RSFA 4 Step Process

Step 1

Identify your insurance objectives via a needs analysis.

Step 2

Prepare a personalised statement of advice once your needs are established, and discuss with you.

Step 3

Once you are satisfied we will implement your Protection Plan (RSFA assists with the application form and liaising with the insurer to achieve the best-underwritten terms).

Step 4

Provide ongoing service by way of annual reviews (there may be a need to review in-between times).

Get started with RSFA

With over 20 years of industry experience, Rod and his team provide expert guidance and top-notch service to help you achieve your financial goals. Reach out to our team today.

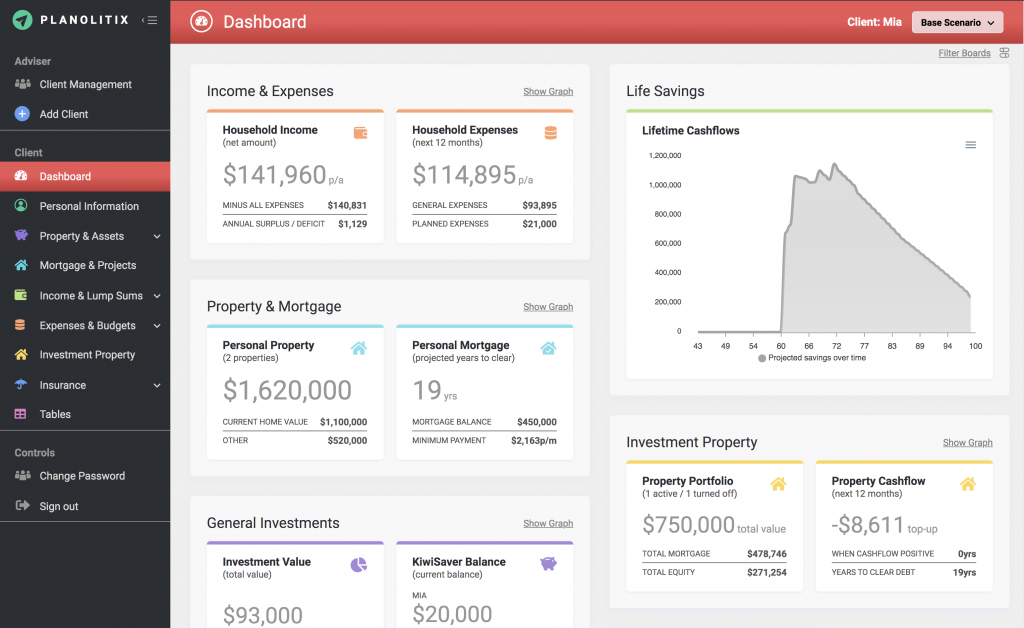

Understand your finances with our financial analysis tools

RSFA Financial Advisers leverage Planolitix to provide clients with comprehensive financial planning and advanced data analysis, ensuring tailored solutions for optimal financial outcomes.

By utilising this sophisticated tool, RSFA Financial Advisers enhance decision-making processes and maximise investment strategies for their clients.

Frequently Asked Questions

The benefit amount for income protection insurance is typically calculated as a percentage of your pre-tax income, often around 75%. This ensures you have a reliable income stream to cover your living expenses if you're unable to work due to illness or injury. The exact percentage and terms can vary by policy, so it's important to review your options with a financial adviser.