Life Insurance

Life insurance pays a lump sum or a monthly income to the owner of the policy (eg – a family member), if you pass away, or are terminally ill.

Life insurance is crucial for families in New Zealand as it provides financial security in the event of an untimely death. It ensures that your loved ones can maintain their standard of living and meet daily expenses.

Covering outstanding debts, such as mortgages, car loans, and personal loans, is another important aspect of life insurance. It prevents your family from being burdened with these financial obligations.

Life insurance also secures your children's future by covering education expenses, including school fees and university tuition. This ensures that they have access to quality education.

Additionally, life insurance can cover funeral and associated costs, alleviating the financial stress on your family during a difficult time. It also acts as a replacement for lost income, helping your family manage their finances and maintain stability.

Overall, knowing that your family is financially protected provides peace of mind, allowing you to focus on living your life to the fullest.

The RSFA 4 Step Process

Step 1

Identify your insurance objectives via a needs analysis.

Step 2

Prepare a personalised statement of advice once your needs are established, and discuss with you.

Step 3

Once you are satisfied we will implement your Protection Plan (RSFA assists with the application form and liaising with the insurer to achieve the best-underwritten terms).

Step 4

Provide ongoing service by way of annual reviews (there may be a need to review in-between times).

Get started with RSFA

With over 20 years of industry experience, Rod and his team provide expert guidance and top-notch service to help you achieve your financial goals. Reach out to our team today.

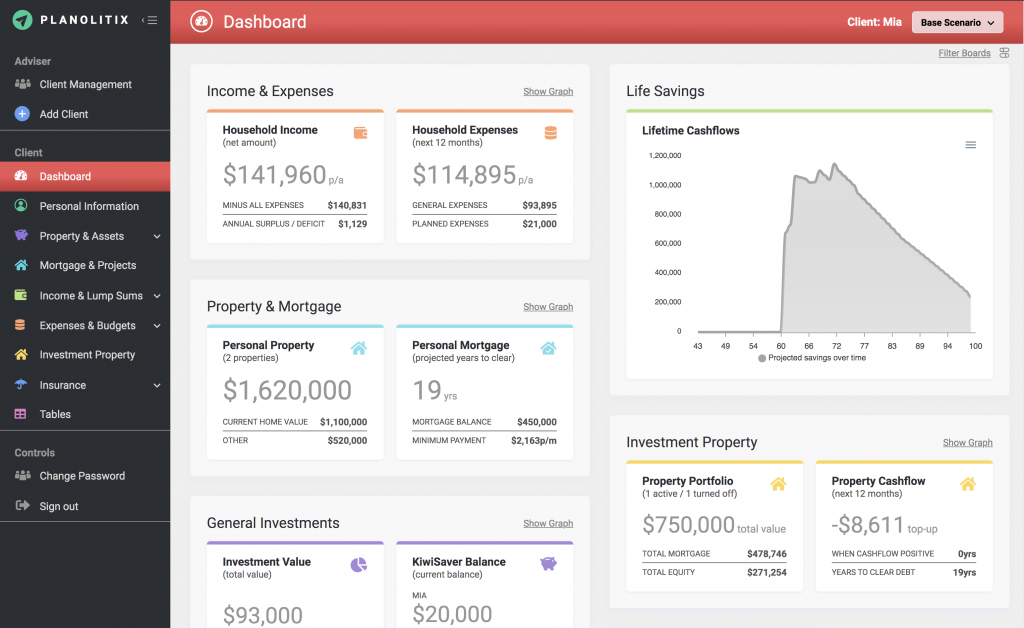

Understand your finances with our financial analysis tools

RSFA Financial Advisers leverage Planolitix to provide clients with comprehensive financial planning and advanced data analysis, ensuring tailored solutions for optimal financial outcomes.

By utilising this sophisticated tool, RSFA Financial Advisers enhance decision-making processes and maximise investment strategies for their clients.

Frequently Asked Questions

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years, and pays out a benefit only if the insured passes away during that term. Whole life insurance, on the other hand, offers lifelong coverage and includes an investment component that builds cash value over time. A financial adviser can help you decide which option best suits your needs.