Key Person Cover

Key person insurance is essential for protecting your business against the financial impact of losing a crucial team member due to illness or death. This coverage ensures that your business can continue operating smoothly during a challenging transition period, providing much-needed stability.

At Real Savvy Financial Advice, we understand the importance of securing your business's future. Key person cover can provide funds to hire and train a replacement, cover lost revenue, and manage operational costs. This financial support is vital to maintaining confidence within your organisation and sustaining its operations.

The loss of a key person can disrupt your business significantly. Key person insurance helps mitigate these risks by offering the financial resources necessary to navigate such disruptions effectively. It ensures that your business can withstand the unexpected loss of a valuable team member.

We offer customised key person insurance policies to suit your specific business needs, ensuring comprehensive protection. By safeguarding your most valuable assets, you can focus on growth and success, knowing your business is well-protected against unforeseen circumstances.

The RSFA 4 Step Process

Step 1

Identify your insurance objectives via a needs analysis.

Step 2

Prepare a personalised statement of advice once your needs are established, and discuss with you.

Step 3

Once you are satisfied we will implement your Protection Plan (RSFA assists with the application form and liaising with the insurer to achieve the best-underwritten terms).

Step 4

Provide ongoing service by way of annual reviews (there may be a need to review in-between times).

Get started with RSFA

With over 20 years of industry experience, Rod and his team provide expert guidance and top-notch service to help you achieve your financial goals. Reach out to our team today.

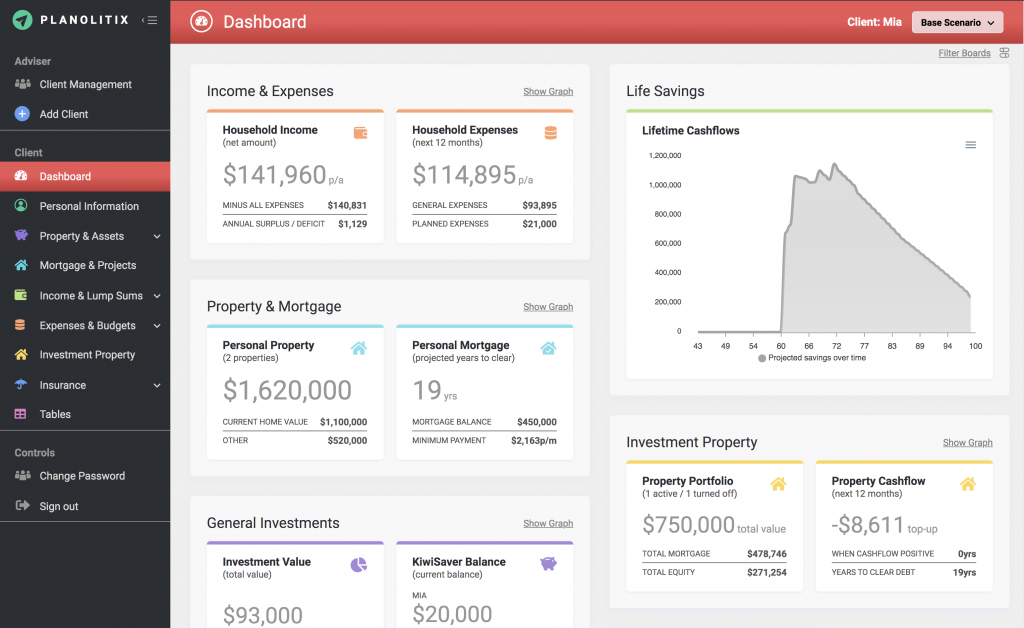

Understand your finances with our financial analysis tools

RSFA Financial Advisers leverage Planolitix to provide clients with comprehensive financial planning and advanced data analysis, ensuring tailored solutions for optimal financial outcomes.

By utilising this sophisticated tool, RSFA Financial Advisers enhance decision-making processes and maximise investment strategies for their clients.

Frequently Asked Questions

The amount of coverage needed for key person insurance depends on several factors, including the key person's role in the company, their contribution to revenue, the cost of recruiting and training a replacement, and the potential impact on business operations. A financial adviser can help assess these factors to determine the appropriate coverage level.