Reverse Mortgages (Home Equity Loans)

Unlock the value of your home with a reverse mortgage and enjoy financial freedom in retirement. At RSFA, we offer expert advice to help you understand and navigate the benefits of reverse mortgages.

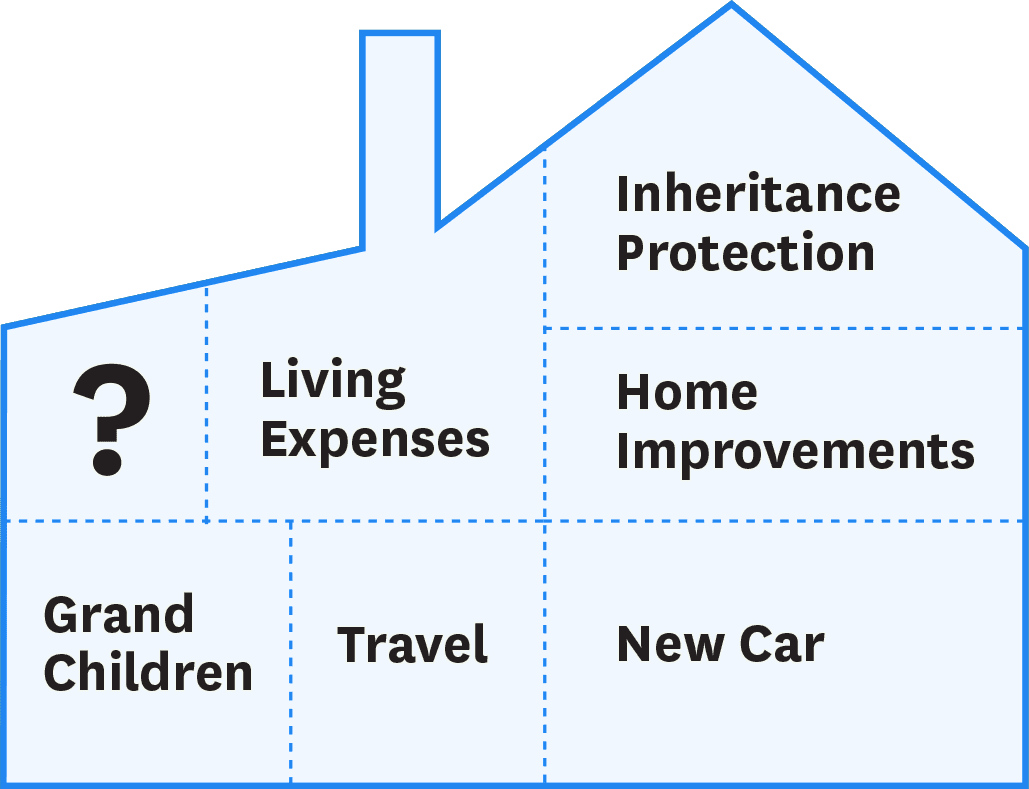

You may look at your equity in your home like this:

If you are 60 and above and have equity in your home, you may qualify for a Home Equity Loan (also known as ‘Reverse Mortgages’). Getting you finance through a main bank is always the priority, if it is viable.

Get started with RSFA

With over 20 years of industry experience, Rod and his team provide expert guidance and top-notch service to help you achieve your financial goals. Reach out to our team today.

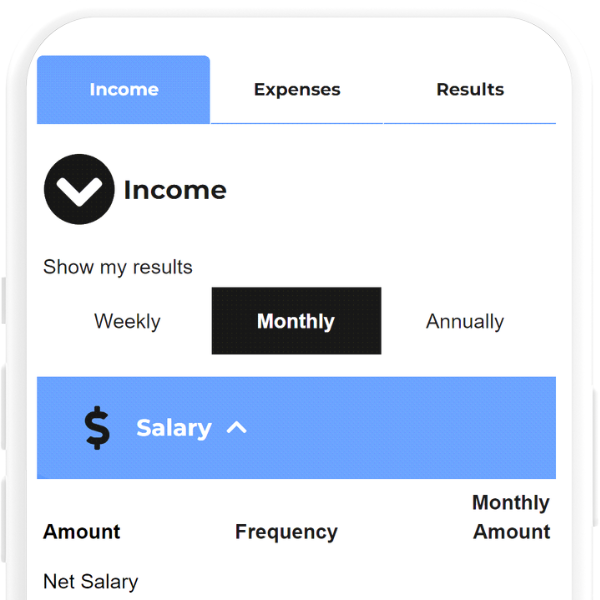

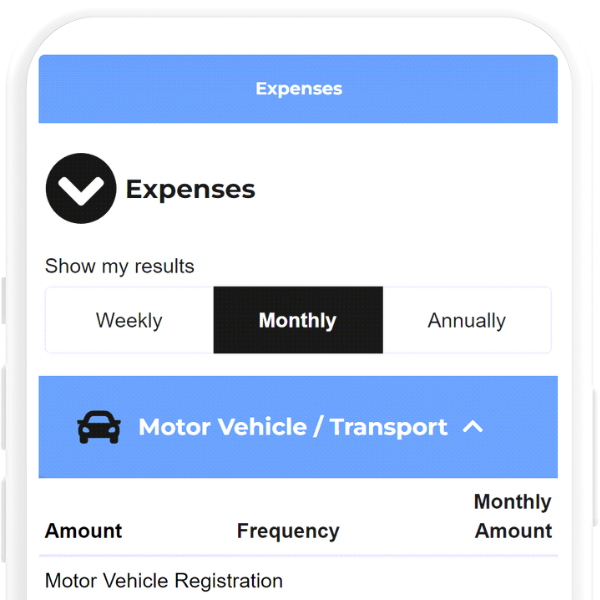

Understand your finances with our financial analysis tools

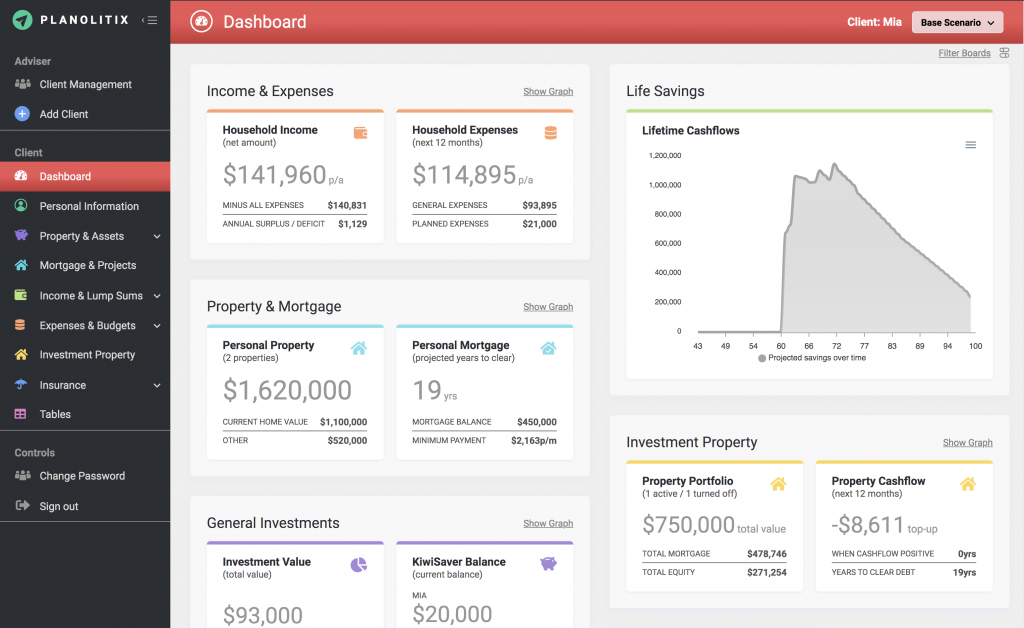

RSFA Financial Advisers leverage Planolitix to provide clients with comprehensive financial planning and advanced data analysis, ensuring tailored solutions for optimal financial outcomes.

By utilising this sophisticated tool, RSFA Financial Advisers enhance decision-making processes and maximise investment strategies for their clients.

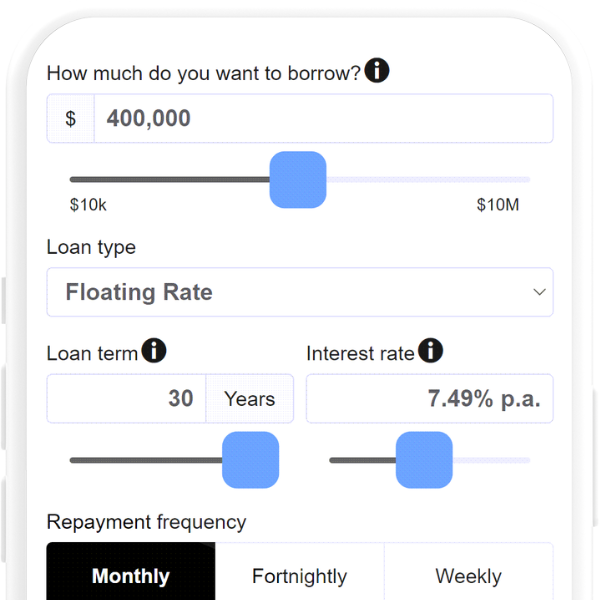

Useful Calculators for Reverse Mortgages

Our website offers a variety of easy-to-use financial calculators designed to help you make informed decisions.

Frequently Asked Questions

A reverse mortgage allows homeowners aged 60 and above to convert part of their home equity into cash without selling their home. The loan is repaid when the homeowner sells the property, moves out permanently, or passes away.